KESD FY26 BUDGET INFORMATION

The KESD school board, administration, staff and students would like to thank our communities for supporting the FY26 budget! We appreciate you flexing your democratic muscles and modeling engaged citizenship for our students. We will do our very best to be good stewards of your investment and support our students' academic, social and emotional growth. Thanks!

Budget Results

731 Yes, 680 No

������ý East School District FY26 Budget

KESD Community Meetings

KESD held two FY26 Informational Budget Meetings. During these meetings, we presented the proposed FY26 budget and answer any questions that community members had pertaining to the budget. There was also be time available for public comment regarding all meeting items.

Please note that the two meetings listed above covered the same budget information, with locations selected to make it more convenient and accessible for community members to attend. Both meetings were recorded via ZOOM.

MEETING RECORDINGS:

INFORMATINAL MEETING

LOCATIONS & DATES:

Monday, February 10th, 2025

- Location: Concord School

- Time: 6PM

Join Meeting via ZOOM:

- Phone Login Info: 1 929 205 6099

- Meeting ID: 891 8168 0384

Wednesday, February 12th, 2025

(2.6.25 Meeting Postponed Due to Weather)

Location: Lyndon Town School (Library)

Time: 6PM

Join Meeting via ZOOM:

- Phone Login Info: 1 929 205 6099

- Meeting ID: 884 3511 6215

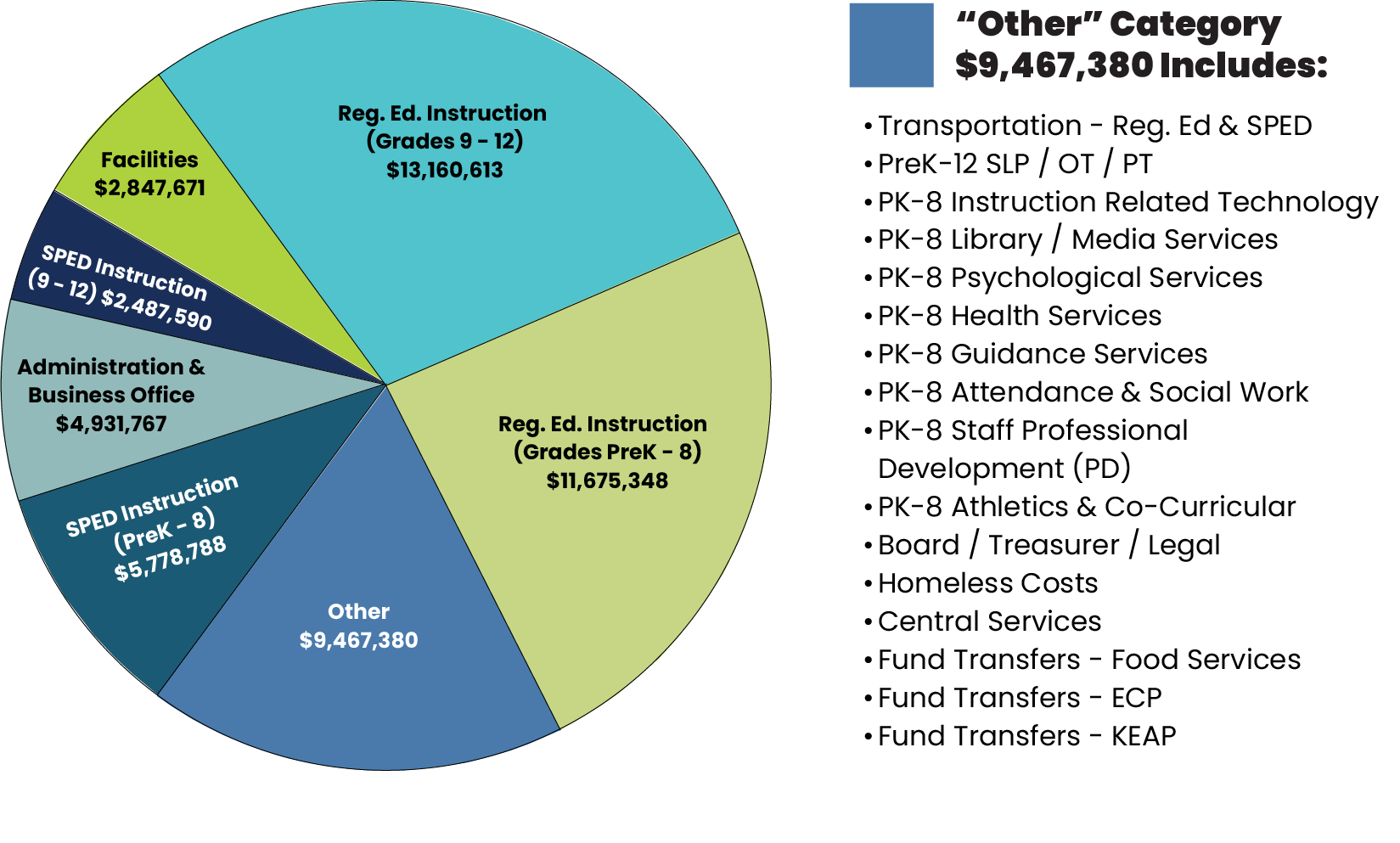

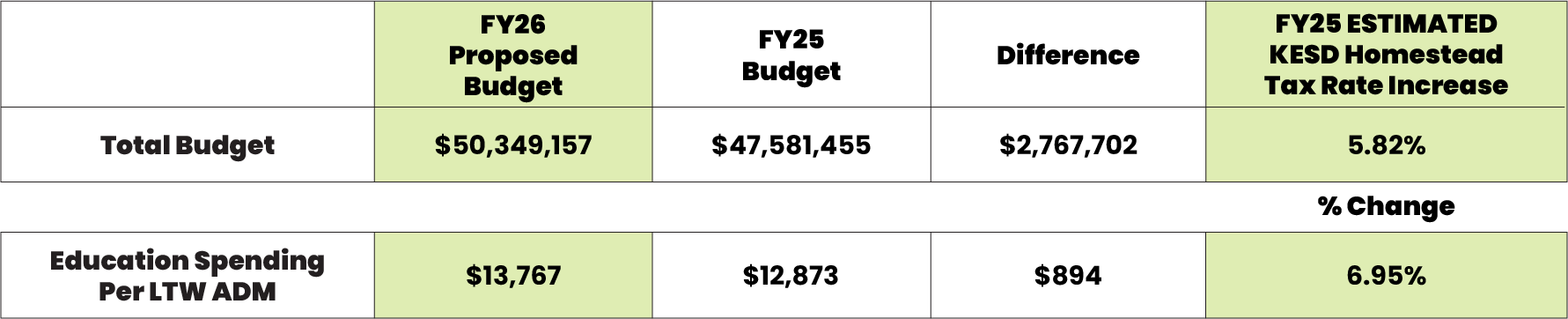

Proposed FY26 KESD Budget

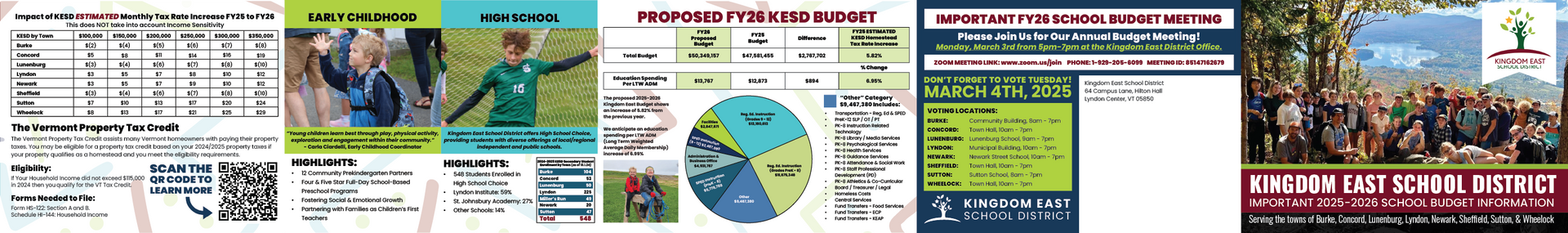

The Vermont Property Tax Credit

The Vermont Property Tax Credit assists many Vermont homeowners with paying their property taxes. You may be eligible for a property tax credit based on your 2024/2025 property taxes if your property qualifies as a homestead and you meet the eligibility requirements.

Eligibility:

If Your Household Income did not exceed $115,000 in 2024 then you qualify for the VT Tax Credit.

Forms Needed to File:

- Form HS-122: Section A and B.

- Schedule HI-144: Household Income

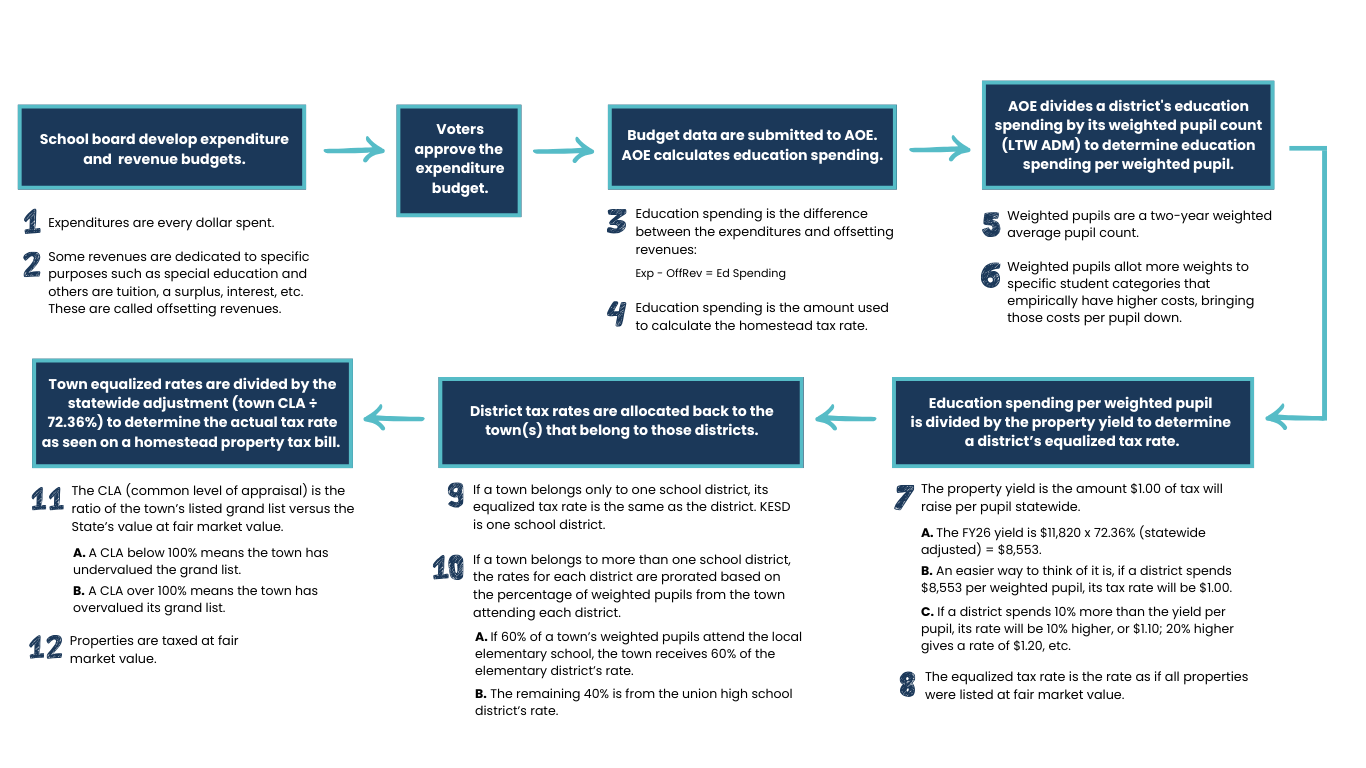

How Education Tax Rates are Calculated